To Californians who think their homeowner association fees are too high: take a dash of solace in knowing it could be worse.

My trusty spreadsheet examined one housing cost the Census Bureau hadn’t previously broken out: dues paid to homeowners’ association or other condominium fees.

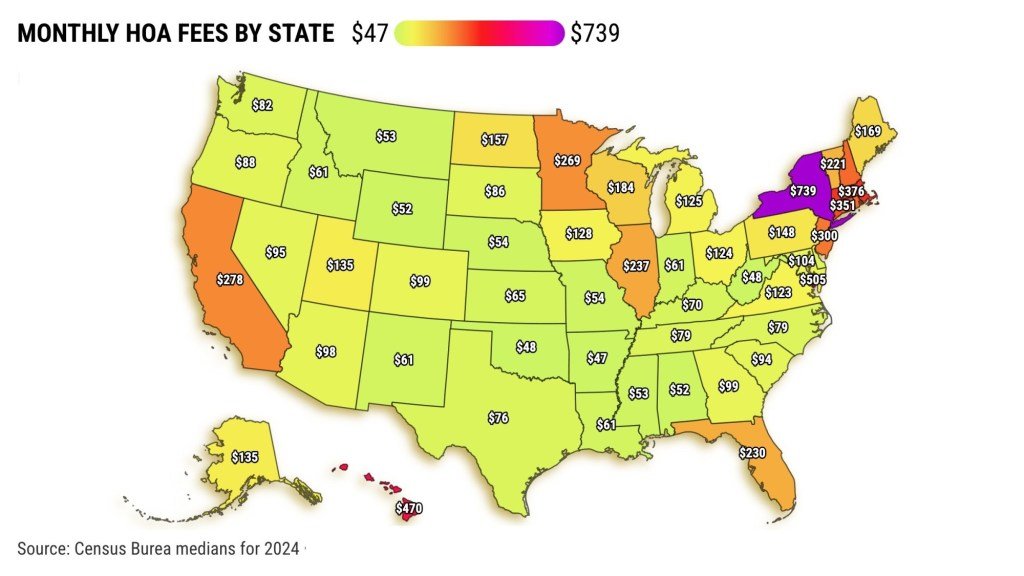

The recent release of 2024 housing cost data tells us that California homeowners paid a median HOA fee of $278 a month, the ninth-highest expense nationally. That’s 106% above the nation’s typical $135 HOA fee.

Look, you could be paying the costliest HOA fees: $739 a month in New York. Then there’s the District of Columbia ($505), Hawaii ($470), Massachusetts ($376), and Connecticut ($351).

Want an HOA bargain? Move to Arkansas for $47 a month, or to Oklahoma and West Virginia for $48, or to Alabama and Wyoming for $52.

Alternatively, ponder California’s major economic rivals: Texas ranked No. 36 at $76, while Florida ranked No. 12 at $230.

By the slice

For some perspective, think about HOA fees as a share of last year’s median expenditures for owners.

In California, these levies equaled 12% of the statewide $2,232 monthly ownership expenses – that’s owners with or without mortgages. The Golden State’s HOA ratio is the 16th highest share among the states and just above the 10% national rate.

Tops? New York at 43%, then Hawaii (24%), D.C. (19%), Connecticut (18%), and Minnesota (18%). Florida was No. 11 at 16%.

Lowest? Nebraska and Washington state at 4%, then Montana, Wyoming, Oklahoma, Missouri and Texas at 5%.

Large group

California had 1.8 million housing units where the owner paid HOA fees in 2024. That’s the third-largest HOA community behind Florida at 2.8 million and Texas at 2.4 million.

That translates to 24% of California homeowners paying HOA fees, or the 17th-highest share among the states. California is just below the 25% national share.

Where are HOAs most common? Nevada, with a 51% share, then Arizona (45%), Florida (44%), and Colorado and Hawaii at 42%. Texas was No. 10 at 34%

Where is it hardest to find an HOA? North Dakota and Maine have only 8% of homeowners in fee-charging associations, followed by Rhode Island, South Dakota and Wisconsin at 10%, and Vermont (11%).

Big business

You can loosely guestimate the collective HOA cash flow by multiplying the median fees paid by the number of dues-paying owners.

By this math, California HOAs collected $6.1 billion in 2024, No. 2 nationwide, and 14% of the $43 billion HOA intake across America.

Florida was No. 1 at $7.6 billion. New York was No. 3 at $5.4 billion, then Illinois ($2.3 billion) and Texas ($2.2 billion).

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com